maryland tesla tax credit

You may be eligible for a one-time excise tax credit up to 3000 when you purchase a qualifying zero-emission plug-in electric or fuel cell electric vehicle. Baltimore-Owings Mills 9428 Reisterstown Road Owings Mills MD 21117 Driving Directions Service 410 415-1411.

Used Tesla Model S For Sale In Baltimore Md Cargurus

Maryland tesla tax credit Friday April 15 2022 Edit.

. When we took delivery part of our. It previously ran out in. If the property is owned jointly by more than one individual such as a husband and wife each individual owner is.

1500 tax credit for lease of a new vehicle. 0 of the first 8000 of the. The minimum credit amount is 2500 and the credit may be up to 7500 based on each vehicles traction battery capacity and the gross vehicle weight rating.

The credit can be claimed on Maryland forms 502 504 505 or 515. Tax credits depend on the size of the vehicle and the capacity of its battery. This expands the tax credit from 3 million total to 6 million for FY 2020 beginning in July 2019.

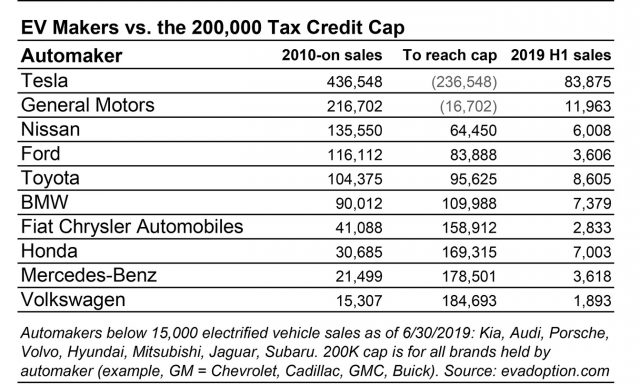

With the passing of the Inflation Reduction Act there is now an EV tax credit available again no more 200000 car cap which Tesla blew through years ago for vehicles delivered starting. Effective July 1 2023 through June. Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug.

Marylands energy storage tax. Marylands energy storage tax credit was established during the 2017 legislative session and will be offered starting in 2018 through 2022. Marylands state electric vehicle tax credit program has proven so popular that rebate funding was depleted for the entire fiscal year before it even began on July 1 2019.

Select utilities may offer a solar incentive filed on behalf of the customer. The tax credit is based upon the amount by which the property taxes exceed a percentage of your income according to the following formula. Electric car buyers can receive a federal tax credit worth 2500 to 7500.

These programs are subject to change or end at any time and are outside of Teslas control. Maryland Tesla Tax Credit. Funding is currently depleted for this fiscal year.

Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Maryland tesla tax credit. With the signing of the Inflation Reduction Act into law on August 16 th 2022 the popularity penalty will disappear in 2023 reinstating the 7500 tax credit for several eligible.

Tax credits depend on the size of the vehicle and the capacity of its battery. Please review the TY 2021 Maryland Energy Storage Income Tax Credit Program Notice of Availability NOA before starting your application. 2500 tax credit for purchase of a new vehicle.

The program was in sore need of this credit.

U S Federal Ev Tax Credit Update For January 2019

Do Electric Cars Really Save You Money

New Ev Tax Credits For Tesla In The Inflation Reduction Act

2022 Ev Tax Incentives And Benefits In Maryland Pohanka Hyundai Of Capitol Heights

Us Federal 7 500 Electric Vehicle Credit Expiry Date By Automaker

Elon Musk And His Global Subsidies Lust Got Musked

Most Popular Electric Vehicles Don T Qualify For Texas Ev Rebate Program Texas Thecentersquare Com

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Maryland Ev Tax Credit Major Funding Increase Proposed Pluginsites

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Get Up To 9 000 To Install Electric Vehicle Charging Here S How Evannex Aftermarket Tesla Accessories

Incentives Maryland Electric Vehicle Tax Credits And Rebates

What Tax Incentives Are Available When Buying My Tesla

Maryland S High Demand Ev Tax Credit Fund Runs Dry Before Fiscal Year Even Starts Electrek

Electric Vehicles Doubled In Maryland In Two Years

As Georgia Recruits Electric Vehicle Maker Rivian The Number Of Evs And Charging Stations Lags

Maryland S Clean Cars Act Is Just Another Tax Break For The Wealthy The Diamondback